Introduction

Stock Trading which involves buying and selling shares of companies to make a profit has been regarded as a source of wealth. However, many people still hold the idea that a lot of capital has to be put forward in the first place. Fortunately, the avenues of this modernized investment avenue, opening up are the nursery to developing into wealth even with little resources. The reason why there is low capital trading has more to do with giving people a chance. Regardless of whether one is a student, newly into the world of work, or simply willing to expand their make-up, they can engage in stock trading as it has low limits. Provided one has a strategic mindset, employs self-discipline, and follows proper guidelines, there is no minimum investment that cannot enable a person to practice trading.

What The Stock Markets Are All About and Step On It

Before engaging in stock trade, one should know the process of the stock market’s inner workings. It is a market for buying and selling the stock of participating companies to their people Parts of the Trade Market as NYSE, NASDA, etc work on trading amongst a seller and a buyer.

Read This: Trading Big Profit: Guide to Maximum Gains in Financial Markets

a) The Main Actors of the Stock Market

- We can point out several participants that maintain the market:

- Retail investor (individual pitches in like you)

- Institutional investors (living pensions, abiding banks, and aggressive hedge funds)

- Market makers (people functioning to create liquidity in the market)

b) Stock Markets and Their Operation, Structure, Hardware

Every exchange is a place to buy and sell. When you decide to trade your order is executed on an exchange in which your order is combined with another order for an opposite action. It follows that every transaction creates interactions that have to be known in order to make decisions within the market.

Advantages of Going Big or Beginning with Small Capital

One of the benefits of starting with low capital is that the amount of financial loss is smaller. You will be able to experiment and learn without putting your entire foot into the water, and helping to stabilize one’s financial standing because you will only invest very little money.

RiskManagementfor NewInvestors

Put in smaller sums of money, so that if the market goes against you, you will limit your losses. Such a strategy would protect you from making costly blunders that most new investors tend to do when they rush into the markets. People get carried away with the idea of success that is obtained overnight but starting with small investment entails clearly Defined Objectives. You won’t wake up rich one day. In a timeframe, it is possible to gather a huge fortune — dripping.

Selecting an Online Broker With Low Commissions

Likewise, there are differences among the brokers, most of which are noticeable in terms of investment amounts. Look for brokers with no account minimums and no commission or commission structures. Some of the reported brokerage sites and services include: – Robinhood: It is a commission-free trading platform that is suitable for small investors. – Webull: This is a trading platform that does not charge fees and presents more than 1 service including tools for stock analysis.

Picking the Appropriate Platform

There is usually lots of leeway in selecting a trading platform especially when considering to start with little amount of capital. Some of the issues worth looking at include cost, user-friendliness, and availability of training resources. Characteristics of Brokerage Accounts with Low Fees or No Commission.It is imperative to check whether the malicious broker that you have chosen does not contain. Low or no trading brokerage commission minimum deposits in their trading account.

Availability of educational resources

Commission-free trades have been made to reality by market platforms such as Robinhood, Webull, and such variants. This allows you to do percent-day trading as much as possible without fear of excessive commissions demolishing your income.

Common Stock Trading Language for a Novice

For one to be able to trade stocks, such must familiarize himself with some lingo. These are usually:

Stocks, Bonds and ETF

Stocks are known as shares of ownership in a corporation. Bonds are certificates of indebtedness issued by businesses or governmental bodies in anticipation of receiving interest payments. An ETF, or exchange-traded fund, contains a portfolio of stocks that trades as though they contain one individual stock.

Market Orders and Limit Orders

A market order is a request made to buy or sell a stock at the current prevailing market price instantly.

Limit sell order means one can place their selling order at a specific price. And wait for that stock to reach that price to execute that trade, thus one has more control over the execution of the trade.

Bull Market vs. Bear Market

A bull market is said to be in place whenever there is a rise in stock prices.

A bear market exists whenever there is a decline in prices.

Strategies for Stock Trading with Low Capital

Developing sound strategies is very important for people dealing with such low amounts of funds. Note the following:

Dollar-cost averaging

This is the strategy in which people invest a fixed amount into a periodic investment scheme regardless of the movement in the price of the stock. It avoids the problems of attempting to guess the right time to invest in the market. And hence gain shares bit by bit over a duration.

Value Investing

This long-term strategy concentrates on identifying companies that are undervalued but have strong fundamentals. As these companies develop, there is a possibility that your investment might appreciate significantly.

Swing Trading for Beginners

Swing trading is all about making money out of buying low and selling high within short time intervals. This type of trading is however more speculative. but you can make money in less time than with other types of trading.

Risk Management and Minimizing Losses

Setting Stop-Loss Orders, Designated loss level at which the order will automatically trigger selling your stock in the limit order. Diversifying Your Investments, By investing in different stocks from different companies or different sectors. you limit the magnitude at which you may be wiped out from further developments in any single investment.

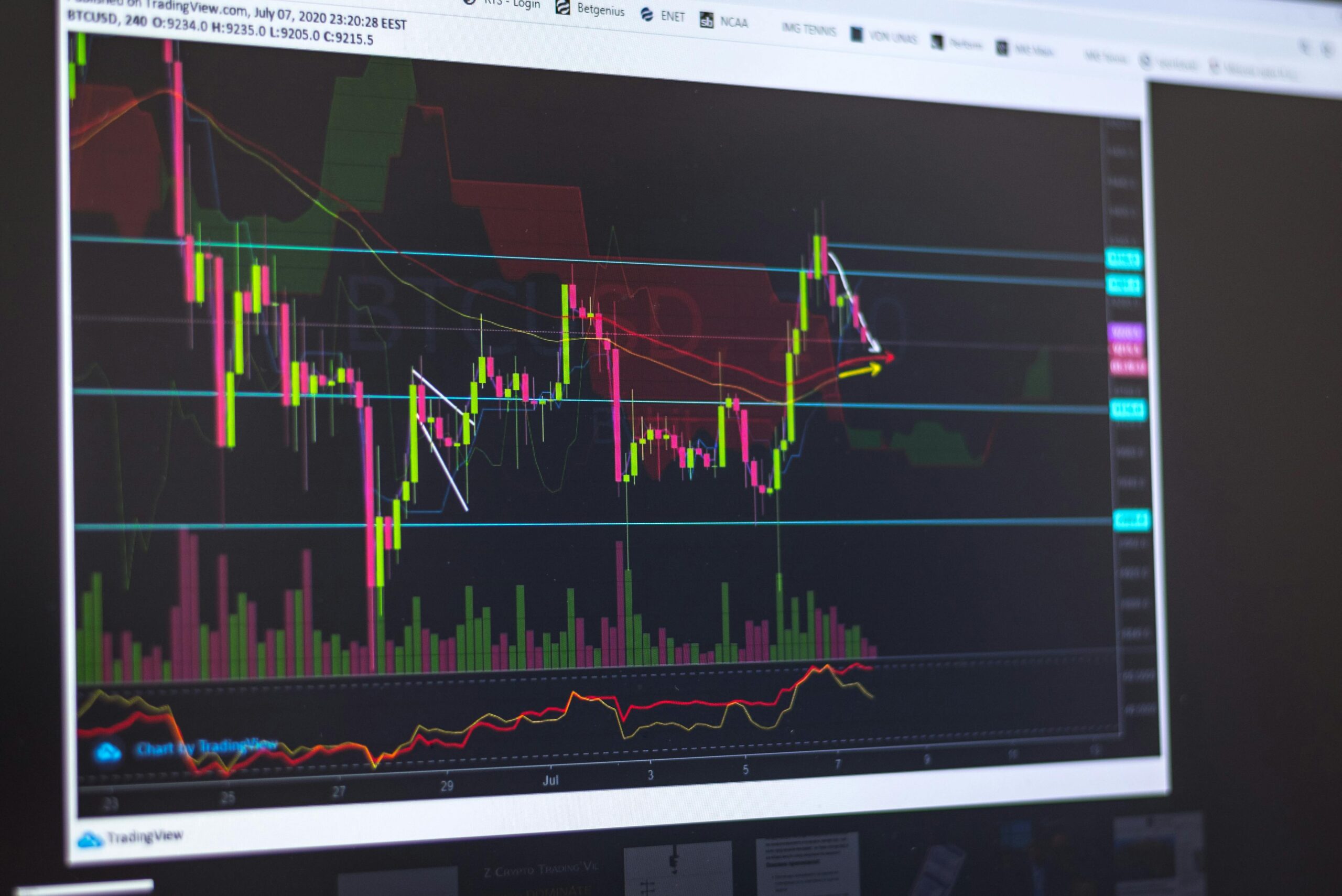

Analyzing Stocks: Fundamental vs Technical Analysis

The first is fundamental analysis, which is related to the health issue of the company. The second is technical analysis, which is bedecked by numbers. The latter in-depth understanding of technical analysis. traders buy and sell based on the future stock movements predicted by the data.

How to Build a Small Portfolio

Getting started with a small amount of money, it is important to pay special attention to the construction of a small but effective portfolio.

a) Investment in Blue Chip Stocks

These are well-formulated enterprises with a history of good performance making them the safest inclusion to any small portfolio.

b) The Growth Stocks Approach

Growth stocks are expected to rise fast but have higher risks involved. Try to even these out with more secure investments.

How Not to Make Such Mistakes

Despite the different goals and backgrounds of many beginner traders. the common mistakes they make can be worked on and eliminated with teaching. When one trades more than is reasonable, one incurs unnecessary expenses and irritates himself in the course of misplaced decision-making. Develop and follow a discipline that maintains a level of calm and logic: Don’t plan on being reactive to price changes. Most probable there is also a commission-free option you’re using to make trades. Don’t forget that there are other fees in the way of fund provision costs or administrative costs connected to transferring funds.

Conclusion

The barriers to entry into stock trading are considerably lowered already. Using the correct platform, strategies, and trouble discipline even the tiniest of investments can be grown into a fortune in good time. More self-control especially concerning the fundamentals remains to be the answer, and more importantly, it to remain self-leafing.