For any trader, whether a novice or an expert, the knowledge of candlestick patterns remains useful because these help to gauge the movement of prices in the future based on the movement of prices in the past. In the wide world of candlestick patterns, one of the most commonly used patterns would be that of Pin Bar candlesticks. Furthermore, looking at the pinbar candlestick as well as knowing how to trade it gives you a lot of competitive advantage in the market. This article presents an adequate explanation where the reader shall learn what a pinbar candlestick is, its functionality, and the techniques for trading in it optimally.

What is a Pinbar Candlestick?

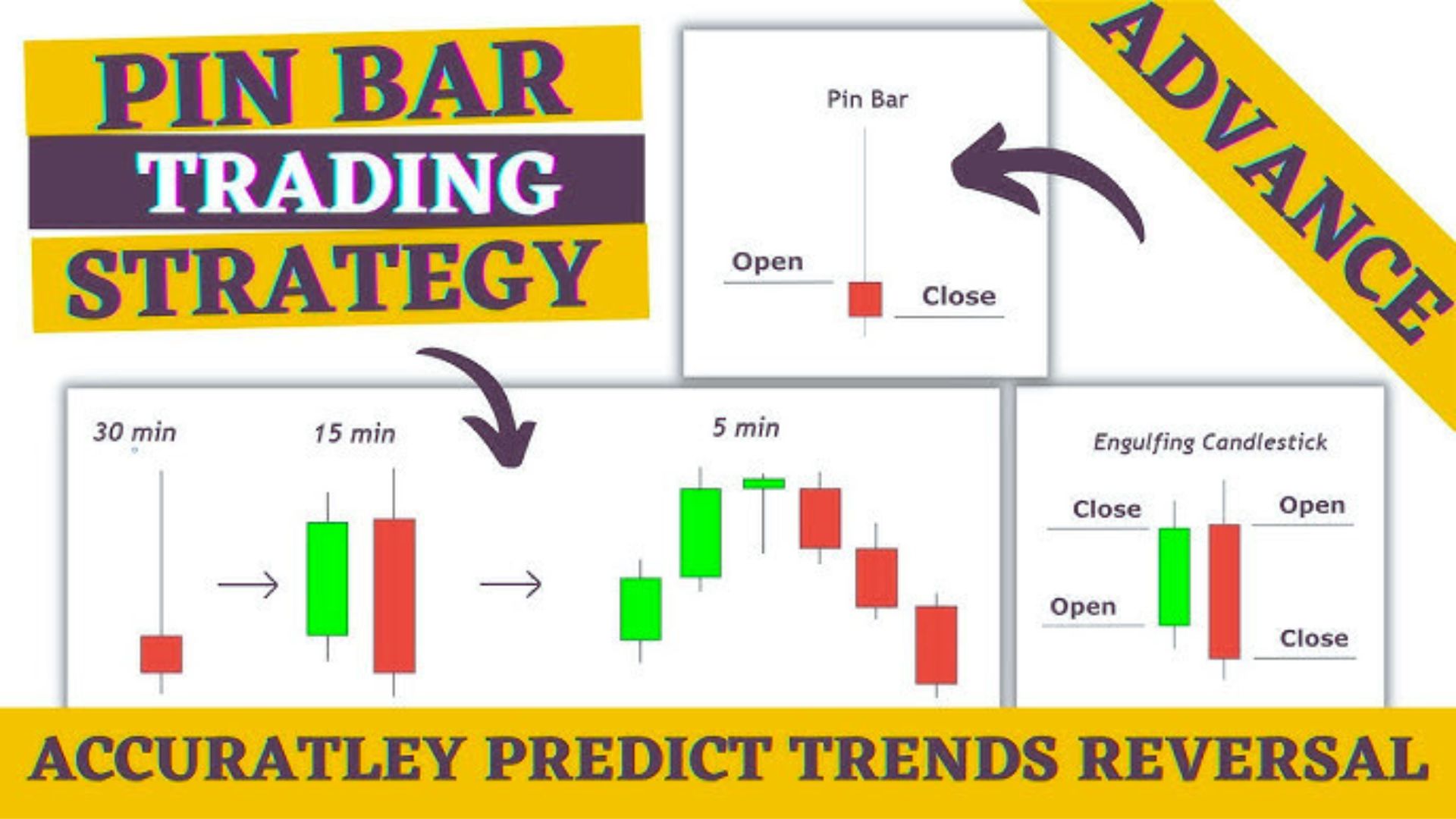

A pin bar, also known as a Pinocchio bar is a simple and effective candlestick pattern, where, based on market movements, the price could change. It has a very small body and a long wick, that is usually longer than the body. It must be noted that the Pinbar has one key element: its long wick, which is the price rejection at a particular price in the direction of the Pinbar, hence recovery.

Two types of pinbars can be observed in the trading chart:

Bullish Pinbar: A bullish Pinbar forms when the price is rejected at a lower level but the close is very close to the high. This indicates that buyers are in control, and a price rise is imminent.

Bearish Pinbar: A bearish Pinbar forms when the price is rejected at a higher level but the close is very close to the low. This indicates that sellers are now in control of the market, and the price may go down.

What is a Pinbar Candlestick and its Key Characteristics

There are several characteristics that a trader should typically focus on to define Pinabar candlestick properly:

Constricted Range: The body of the candlestick is small relative to the maximum range bothered by this candle. It contains both the closing and opening price in a particular time frame.

Long Wick (Shadow): The wick of a Pinbar candle should be at least two or three times longer than the length of the body. The wicks can be determined as a sign of reversal and the greater the wick, the more elaborate the reversal will be.

Position of Wick: The wick in the bullish pinbar whose location is usually under the body should also be extended outwards. In a bearish pin bar, the wick should be above the body. This indicates where the price was rejected.

Pinbar within the Context of Range: Pinbar candlestick patterns work efficiently at the important support or resistance levels after a range is established. This increases the chances of reversal.

Best Practices of Trading Pinbar Candlestick Patterns

Pin bars are very effective sell and buy signals for reversal however caution is oftentimes the key when one is to trade it and strategies employed. After understanding this reversal signal, steps and strategies for trading Pinbar candlestick patterns effectively follow.

1. Cut the Clutter & Get the Trend

Trading pinbars is more effective in a trending market. Make sure you note the direction of the market moving before executing the trade. A bullish Pinbar is effective during an uptrend or at the end of a downtrend. Since it shows the price movement expectations in the bullish direction. A bearish Pinbar is effective during a downtrend or at the end of an uptrend as it shows with high probability the price is going to decrease.

2. Look for Confluence with Support and Resistance Levels

To increase the effectiveness of a Pinbar, it should also be at a major support or resistance area. In the case of a Pinbar forming close to a support level in an uptrend. It increases the chances of the more clearly upward reversal. So is the case of a bearish Pinbar which breaks out of a resistance level which suggests a movement of price down.

Read This: Position Trading: A Comprehensive Guide to Long-Term Market

3. Confirm the Reversal with Other Indicators

To make this Pinbar reversal sign more reliable, it can be used with other technical signals or indicators too. For example:

Moving Averages: Bullish pin bars formed above long-term moving averages indicate that the price could move up more.

Relative Strength Index (RSI): When the RSI goes against the position of price with the foreign currency pin bar. An overbought or oversold situation is at hand, increasing the chances of price reversal.

4. Entry and Exit Strategies

So when you are trading a Pinbar, the entry point is very important. For a bullish pin bar, first, it is best to place a long position a few pips more than the actual high of the pin bar. For a bearish pin bar, one should enter a short position with a few pips less than the low of the pin bar.

This goes further to consolidate the bias that the price is retracing and in what direction.

Regarding the subsequent exit tactics. One is free to apply a common practice where the stop-loss dimming is based on the size of the Pinbar. A stop-loss should be placed just below the bottom wick of a bullish Pinbar or on top of the top wick of a bearish one. Moreover, you can also set profit objectives at areas. Where the price has once reached and won’t breach such as highs, lows, or Fibonacci retracement levels.

5. Risk Management

Like any other candlestick patterns, Pinbars are not 100% effective and as such, risk management must be put in place. Always have a stop loss which is pre-determined to shield your money. Generally, don’t be tempted to risk over one or two percent of your capital at one trade. Also, in each trade, make sure that the risk-to-reward ratio is ok (not less than two to one). And thus as much as you would lose, you must make twice.

Common Pitfalls to Steer Clear From When Buying or Selling Pinbars

Even though the Pinbar is a sound pattern, it is sometimes capable of giving you false signals. Here are some areas you should not venture into:

Pin-bar Trading In A Pin-bar Range: Admittedly, pin bars are not in such great demand in the sideways or range-bound markets. Do not trade Pin bars in ranging markets and only trade Pin bars on trending markets or at the extremes of support and resistance.

Ignoring the Context: A Pinbar tendency to emerge mid-trend without nearby support or resistance is reduced. Do not forget to take a wider view of the market each time before opening a position.

Trusting the Pinbar Fully: The market has a high upside potential. This after using Pinbars as a reversal signal rather brings further losses. Bear in mind that technical analysis should go along with pinbars to improve the chances of success.

Conclusion of Pinbar Candlestick

The Pinbar trading system is an effective, uncomplicated system that most traders would utilize. As it provides one with thorough and possible market direction changes. If this approach is applied along with appropriate risk control and other technical indicators. It can lead to good results on the FX, equity, and commodity markets. It also enables a more effective approach to making trading decisions. Particularly regarding when a trader ought to trade Pinbars at major support and resistance zones. Use the patterns consistently, and you will start seeing them in the future and trading them. As well without the slightest of doubts.